Interest Rates

RCM Managed Asset Portfolio

By Christopher Chiu, CFA

September 2024

Interest Rates

Higher interest rates are bad for existing stocks and bonds. This is because high interest rates make a high rate of return easily available to investors. And this can make the return of existing stocks and bonds less desirable. For example, in 1981 when the Fed funds rate (the interest rate by which banks borrow from the Federal Reserve Bank) was set at a high level of 20% in order to bring down inflation, stocks and bonds were at their nadir. Why invest in stocks and bonds when you could get close to 20% interest simply from depositing it in the bank? But when interest rates were allowed to come down gradually over the next two decades with each interest rate cycle, we had a decades-long boom in bonds and stocks as buyers were enticed to invest in the market.

While nothing like this kind of scenario exists for interest rates today, the current Fed funds rate at 5.5% sets the highest level of interest rates that we have seen since 2007. So, if you believe interest rates will gradually be headed even higher during the next interest rate cycle, then stocks and bonds will be swimming against the tide, as more and more investors are lured away from investing in the market. But if this current Fed funds rate level of 5.5% goes no higher for the foreseeable future, then stock and bond investments will have an added tailwind to bolster their value.

Since I have spoken of stocks and bonds as long-term investments, I will now go through the mental exercise of trying to see where interest rates can go over the next decade, sifting through some possibilities and variables that are available to us today. Of course, there are always variables we cannot anticipate, but that shouldn’t prevent us from going through this kind of exercise, so that we are less surprised when prices change.

What will be the next move for interest rates?

In the near term, over the next year or so, the next move for interest rates will be lower. This is what usually happens late in an economic cycle as the economy weakens and unemployment, which is at a cyclical low, begins to increase. The Fed will lower rates to combat a weakening economy. As a result of their actions, it is hoped that both employment and economic growth are stirred out of their doldrums. But though lower interest rates improve the investment environment, this does not mean stocks and bonds are immediately guaranteed to react positively. That also depends on investor confidence—that these securities will continue to maintain or grow their yield in the face of the economic headwinds which occur during a recession.

How low will rates go?

We know that in the near term the Fed will lower rates. But how low will they lower them? Will they lower them to near zero as they had done in 2008 during the great financial crisis and again in 2020 during the COVID shutdown? In both cases there was a fear that the shock to economic demand would be so great that it would cause large parts of the economy to cease functioning.

These two examples allow us to consider two possibilities for how low rates will go. (1) If, in a weakening economy, there is a similar shock to demand as before, the Fed will likely lower rates to near zero again. In this case, the price of securities will be fairly volatile because of the ensuing economic shock, but valuations will be allowed to go higher in the future because interest rates will be near zero. (2) However, if there is no shock, and we get a benign recession, then rates will likely be lowered to long-term inflation expectations, which is currently running around 2.4%. It is hoped that rates at these lower levels will be all that is needed to stimulate the economy. In this case, the pricing of securities will not be as volatile, but the valuation of securities will not be as robust as it would have been if rates were near zero.

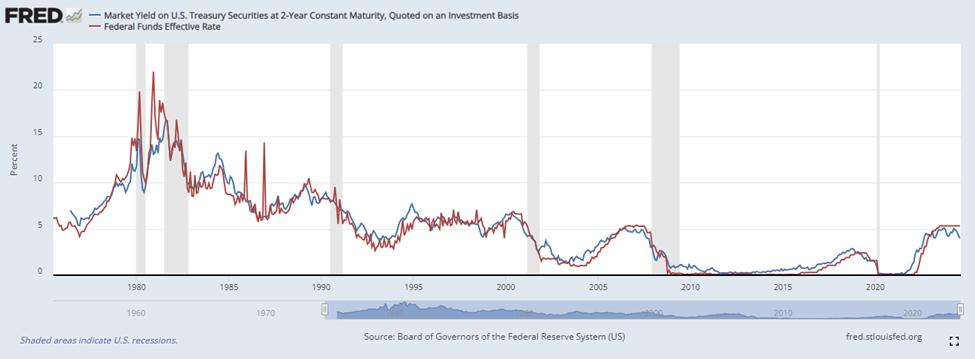

How the Fed funds rate is ultimately set is determined as much by the bond market as by the Federal Reserve Bank. Generally, the Fed funds rate closely follows the 2-yr government bond yield. Many observers believe it is the Fed which directs interest rate policy, but the data would appear to show that it is the bond market which leads the Fed’s decision-making policy. In other words, the bond market tends to anticipate strengthening and weakening in the economy and the Fed’s subsequent policy reaction. Note the chart below: Since the time Volcker’s chairmanship, it is usually the blue line, the bond market, that precedes the Fed decisions (red line) in determining a rise or decline in rates.

The Fed funds rate correlates highly with the rates on Treasury securities because on a practical level they both represent things that banks do with their money when they can't think of anything else to do with it—they either lend it to the government or to other banks. If banks think the Fed funds rate is too low in the current environment, they will start buying Treasury securities instead, which will bring rates on those securities down. If they think it's too high, they'll start liquidating their Treasury securities in order to have cash on hand to lend to other banks, causing the rates on those Treasury securities to go up.

What will be the path of rates afterward?

But where will rates go after they reach the bottom of this current interest rate cycle? Some observers, such as Jim Grant, believe we are at the start of a new interest rate regime. While interest rates have been in a long-term decline since reaching a high in 1981; now, these observers say, with the recent spike in inflation, the worm has turned—the inflation of 2021-22 is an indication interest rates are in for a gradual, long-term upswing.

If these observers are right, that interest rates are now on the upswing, it won’t be because interest rates are simply fated to rise after falling for decades. Higher interest rates are not a foregone conclusion but the result of preventable human action. For example, one important factor that affects the future long-term interest rate path is the fiscal policy of the next few Presidential administrations. If either political party is willing to run the risk of more fiscal spending and budget deficits to garner votes, there will likely be an inflationary effect and with it higher interest rates. This is because, as I have written about before, higher government spending creates more economic demand than there otherwise would have been.

If rates go higher than people expect because inflation runs higher, this will ultimately be a headwind for your investments. This is why balancing future government budgets is so crucial. If there are cuts in government spending, interest rates may be allowed to stay lower for longer, which will be very good for investments.